Customer Churn Analysis

Business Request & User Stories

Every business has customers, but not all of them stay indefinitely. Customers come and go, and the rate at which they leave the business relative to the total number of customers is known as the churn rate or customer attrition. This term essentially represents the rate at which customers are lost.

Customer churn analysis involves examining the churn rate in relation to various factors to identify what influences customer departure. The primary goal of this analysis is to uncover insights that can inform strategic decisions aimed at reducing churn. By understanding and addressing these factors, businesses can improve customer retention and sustain growth.

Request For The Bank Customer Churn Analysis

Dear Data Analyst

We need your expertise to develop a dashboard for our "Bank Customer Churn Analysis" that displays our key performance metrics for informed decision-making.

Requirements

* Customers by Gender

* Customers by Activity Status

* Customers by Credit Card Status

* Customers by Country

* Customers by Products

* Customers & Churn rate by Age Group

* Customers & Churn rate by Credit Scores

* Customers & Churn rate by Account Balance

Design & Aesthetics: Use our company colors and ensure that the dashboard is easy to navigate.

Data Source: Access to our databases will be provided.

Deadline: We need a preliminary version ASAP.

Please provide an estimated timeline for completion and recommendation based on the insightts and key-learnings deduced from the analysis

Best regards,

Project Overview

The primary goal of this analysis is to uncover insights that can inform strategic decisions aimed at reducing customer churn. By understanding and addressing the factors contributing to churn, businesses can improve customer retention and sustain growth.

Objectives:

- Identify Factors Influencing Churn: Analyze customer demographics and financial behavior to determine key factors contributing to customer churn.

- Evaluate Customer Segmentation: Segment customers based on identified factors to understand different customer profiles and their propensity to churn.

- Recommend Strategies to Reduce Churn: Provide actionable insights and recommendations to reduce churn and enhance customer retention.

Key Metrics:

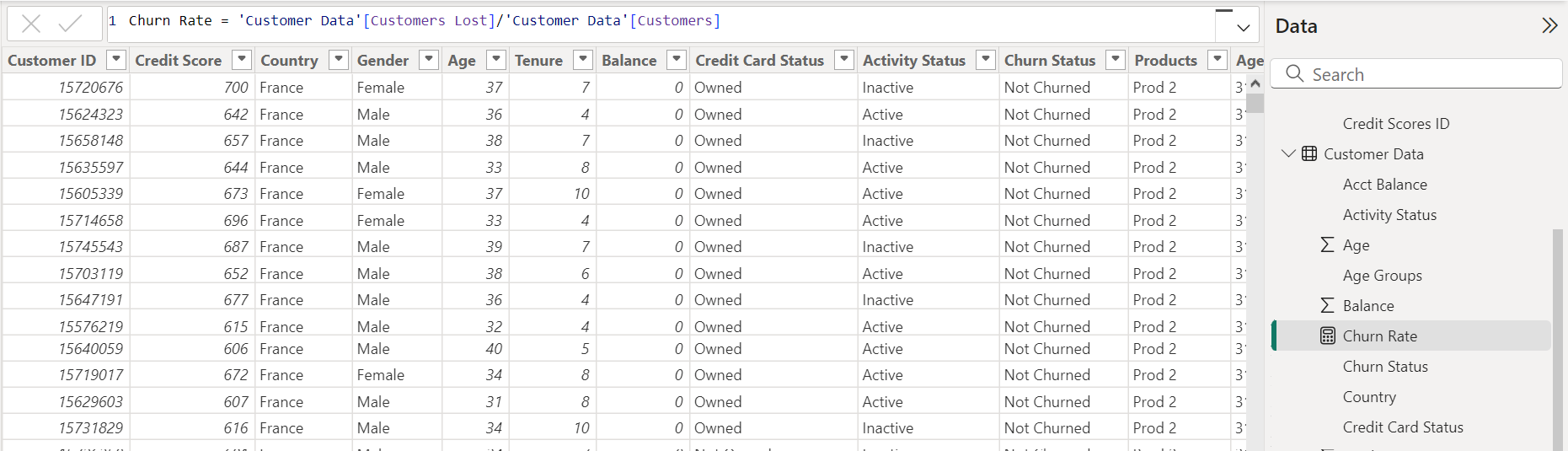

- Churn Rate:Percentage of customers who have churned within a specified period.

- Credit Score:Average credit score of customers and its distribution across churned and non-churned customers.

- Customer Demographics: Distribution of age, gender, and country among churned and non-churned customers.

- Tenure: Average tenure of customers and its impact on churn.

- Balance: Average account balance and its correlation with churn.

- Product Usage: Number of products used by customers and its relation to churn.

- Credit Card Ownership: Percentage of customers with a credit card and its impact on churn.

- Active Membership: Proportion of active members and their churn rate.

- Estimated Salary: Average estimated salary and its influence on churn.

The project workflow is explained below;

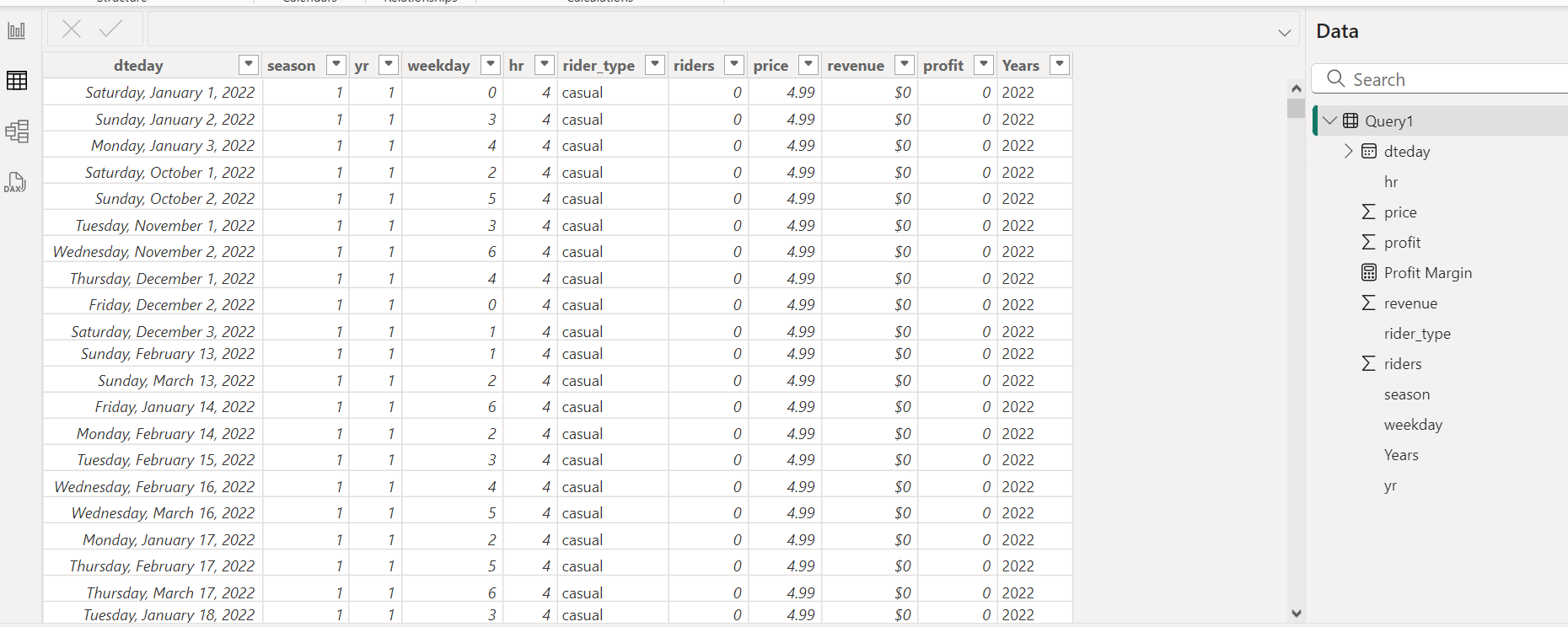

1. Data Collection

2. Data Preparation

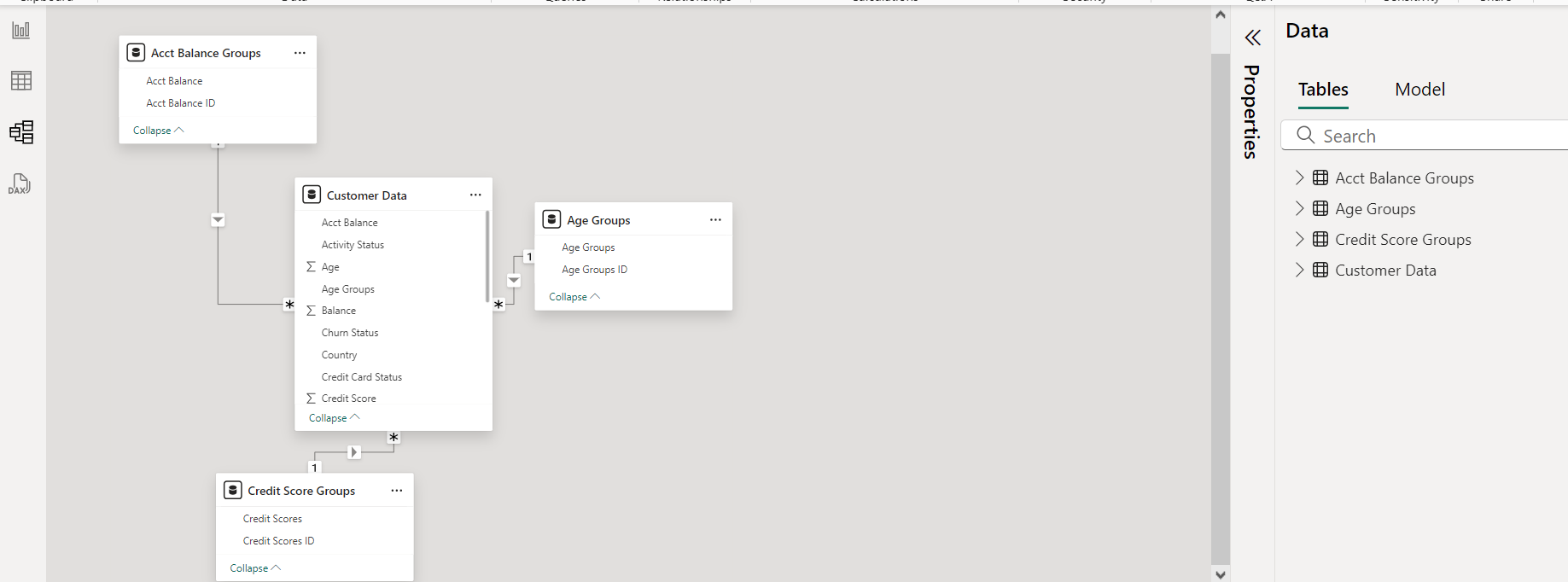

3. Data Modelling

4. Data Analysis

5. Data Visualization

6. Insights & Key-Learnings

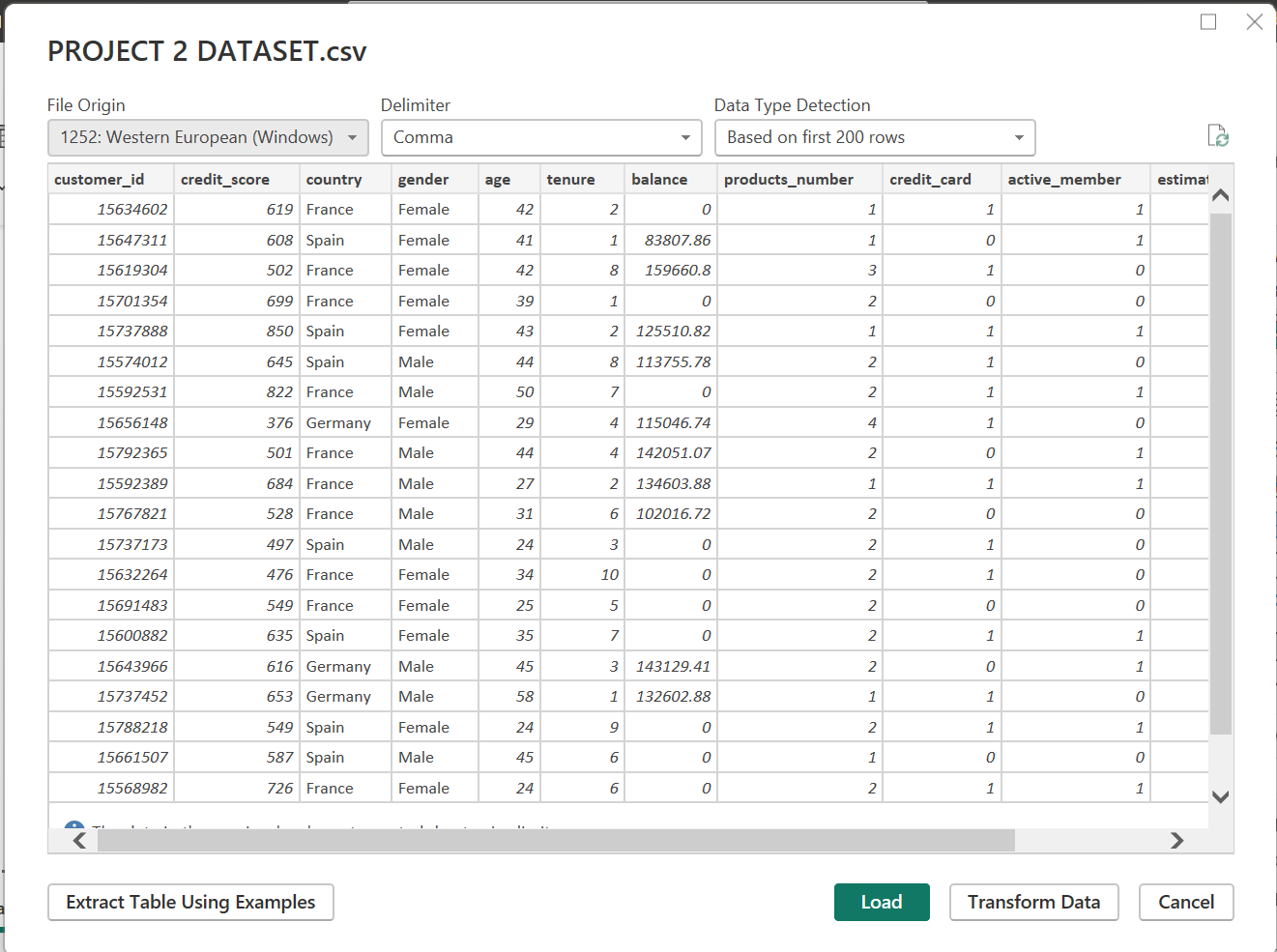

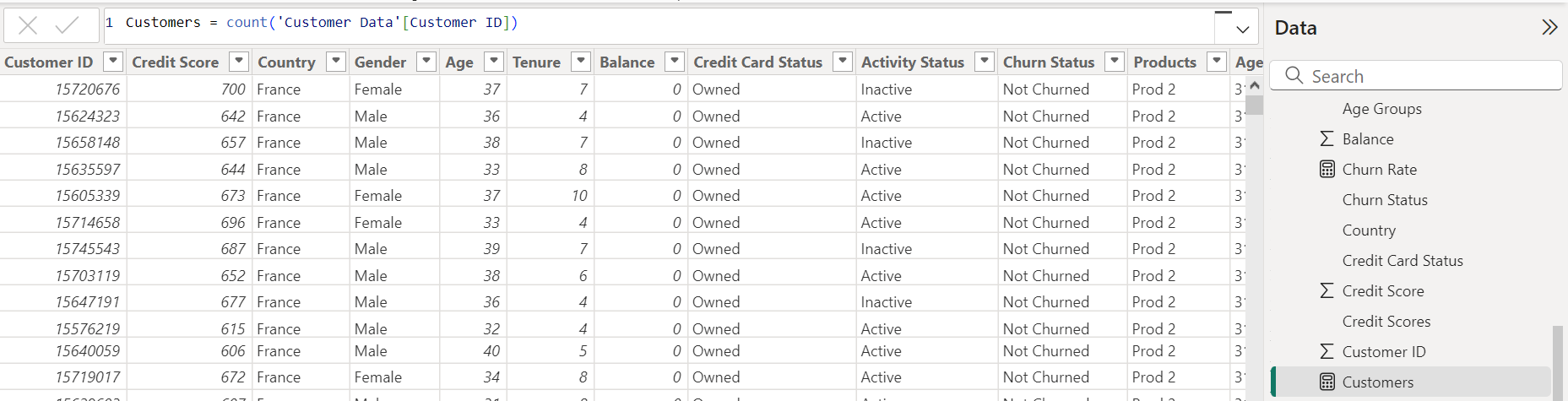

1. Data Collection

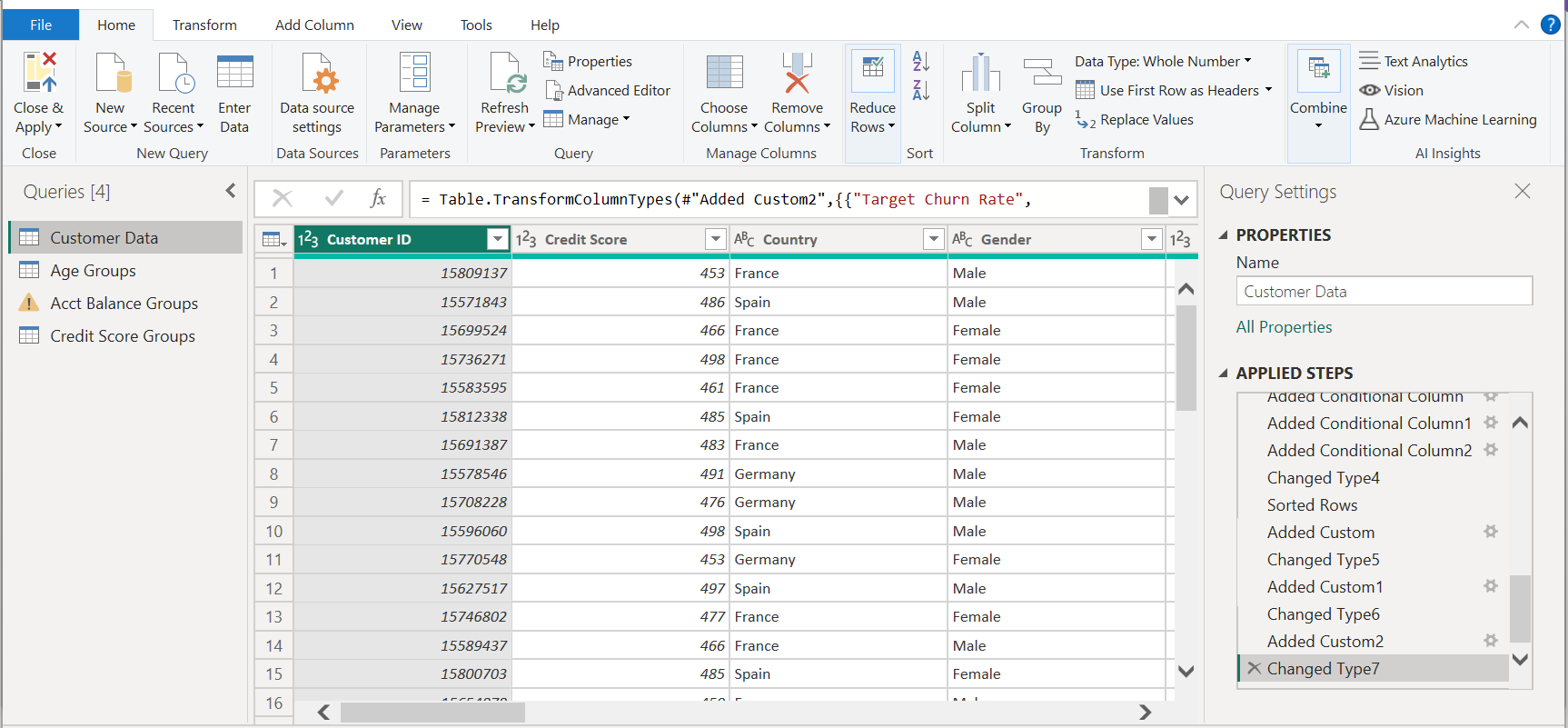

2. Data Preparation

3. Data Modelling

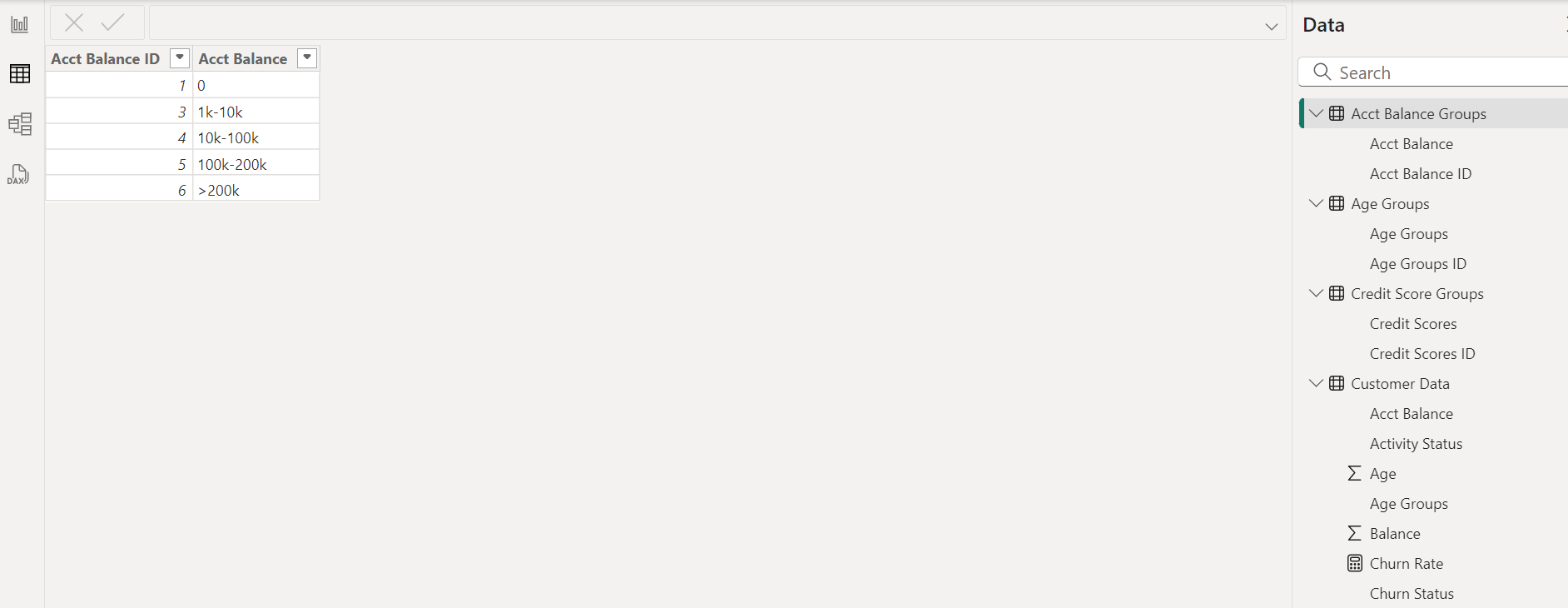

Account Balance Grouping

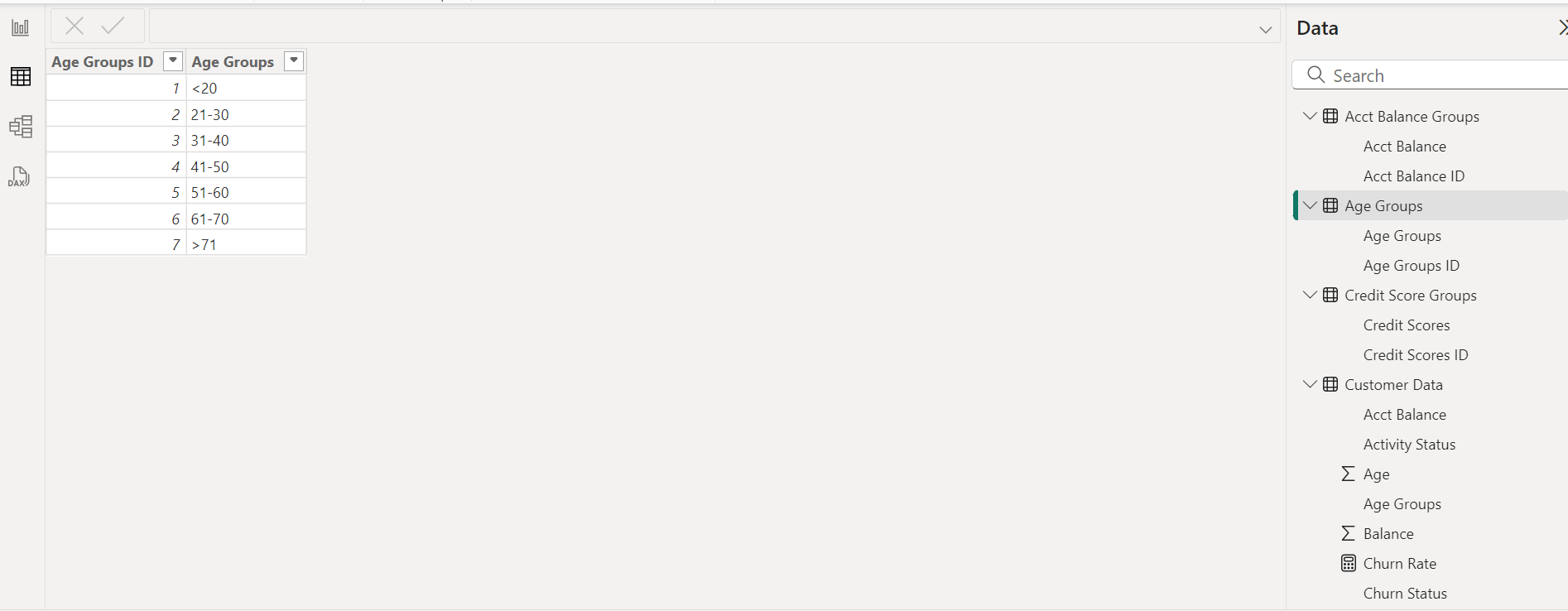

Age Grouping

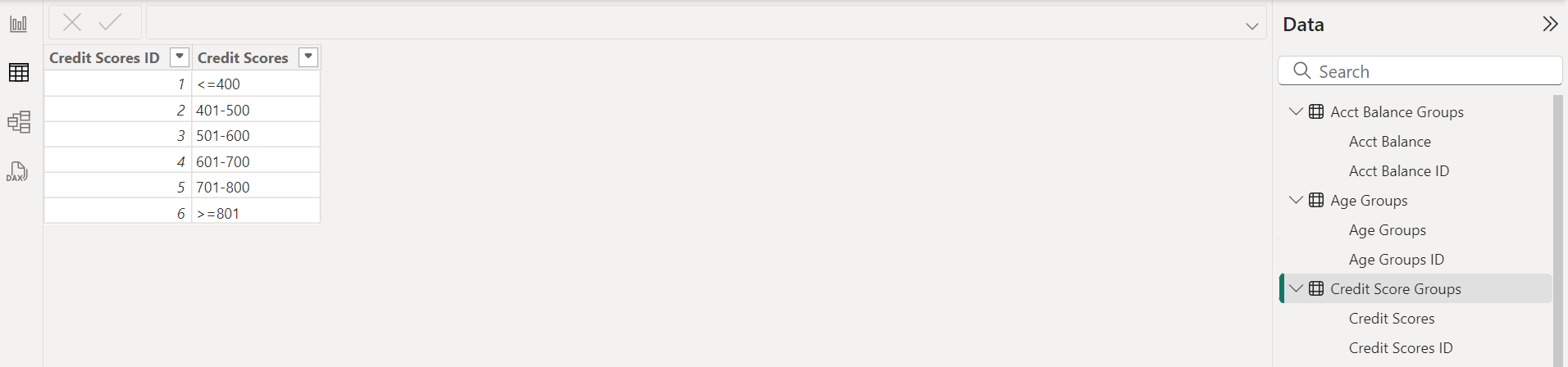

Credit Score Grouping

4. Data Analysis Expression

Churn Rate

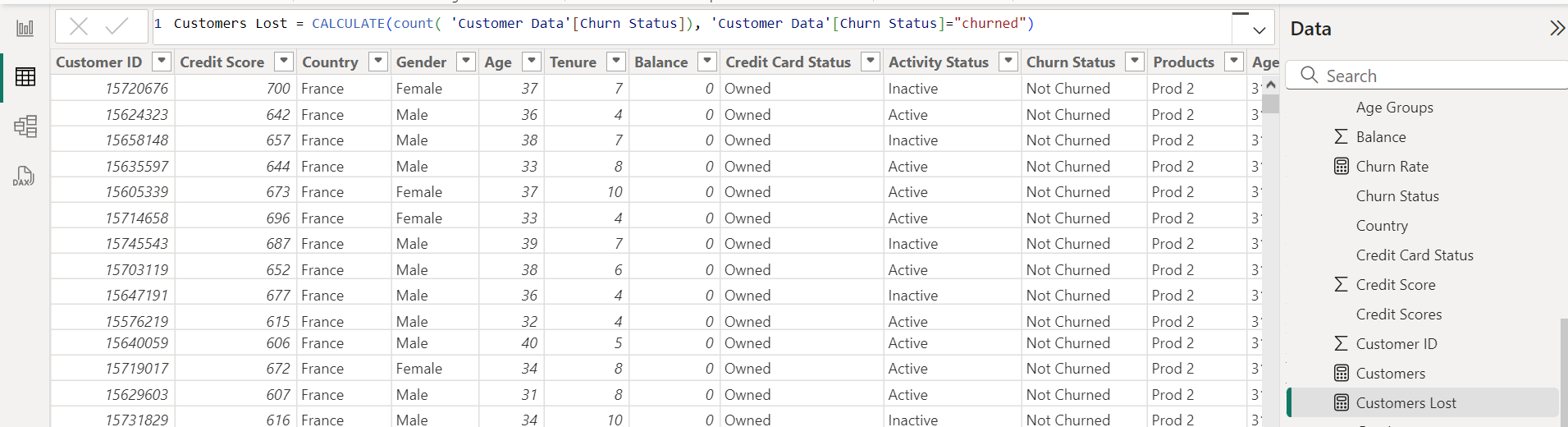

Customer Lost

5. DATA VISUALISATION

6. Insights & Key-Learnings

The target Churn rate for this project is 15%.

The maximum churn rate is 100%.

Note that: Churn rate depends on the the nature of Industry/Sector, Churn rate varies.

A company like utility bills company where alternatives are less always record a low churn rate while companies like mobile phone providers, observe a high churn rate as people always shop around for better deals.

For the male customers, the maximum churn rate is in the category of (51-60) year old i.e. 57% and their overall churn rate is 19.7%.

For the churn rate by credit score, the highest is for people with low credit score <400.

For the churn rate regarding the account balance status, the churn rate is high for customers with really high account balance, people with more than 200k in their bank account, they shop around because they have money, therefore they always want the best interest rate, best facilities and best customer service.

RECOMMENDATION

That the company provides better customer service to people with high account status to gain their loyalty and present the long term customers an amazing offers so they can bring more referrals to the business.

That the company engage their customers to improve their NPS thereby working towards achieving the target churn rate of 15%.